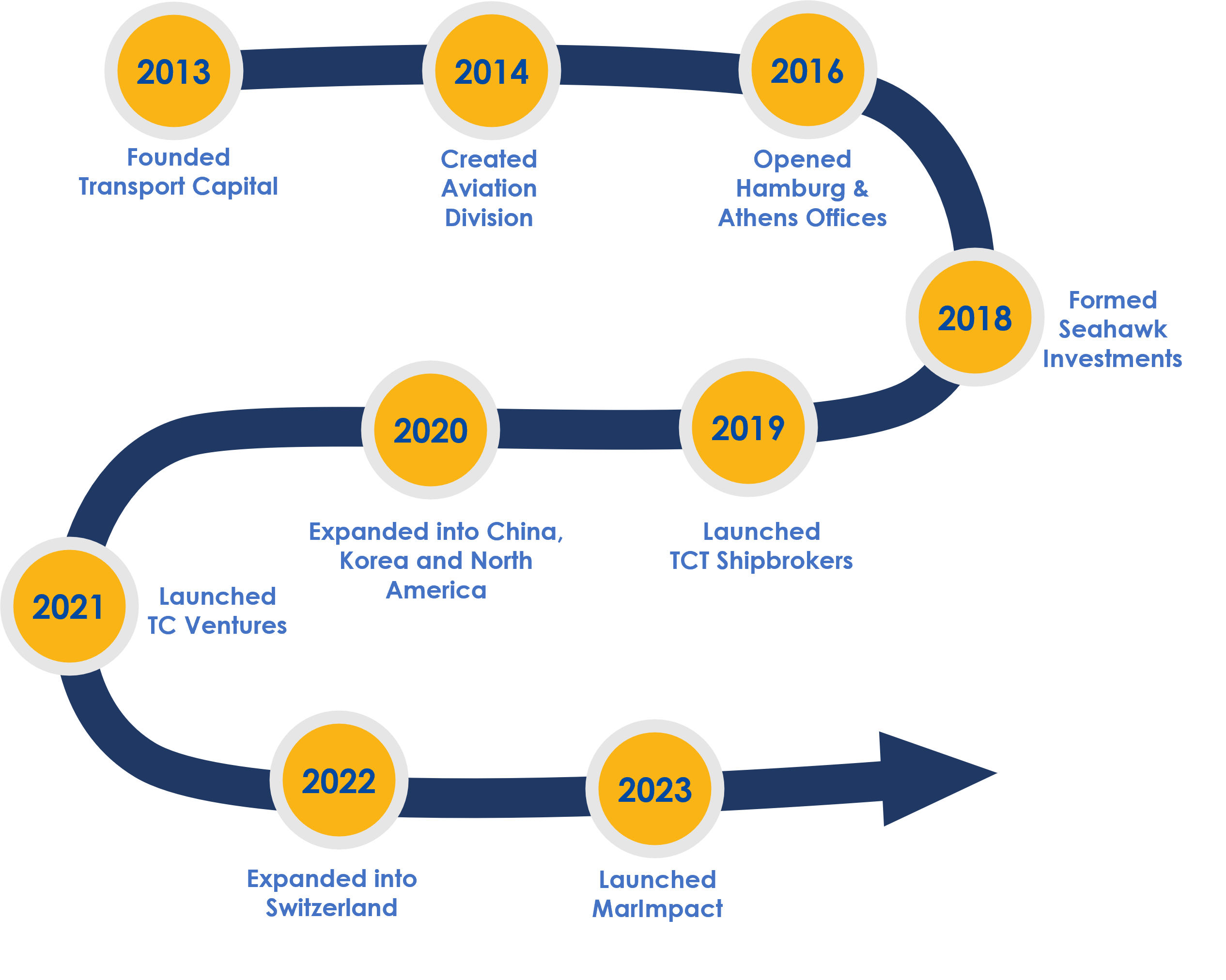

Established in 2013 Singapore-headquartered Transport Capital started out as a shipping-focused Real Assets Management company.

Since then, we have grown into an international group of companies offering various specialist services with an industry focus on Maritime and Aviation. Our aspiration is to be a trusted and forward-looking partner of international transport operators and their capital providers.

OUR SERVICES

We provide the full suite of Maritime and Aviation real asset management services on an à-la carte basis and tailored to your needs.

We raise private capital across the full capital structure for private and public companies.

Seahawk Investments is our investment management arm which offers regulated investment management services in the area of absolute return and multi-asset strategies.

MarImpact is our investment platform focused on low to zero emission vessels.

TCT Shipbrokers is our shipbroking business covering newbuilding, S&P and chartering across all ship types.

Sustainability has been integral to Transport Capital right from the start. This commitment continues to shape the business and paves the way for a greener tomorrow. Learn more about our ESG initiatives, progress, and milestones in our annual Sustainability Report.

Since 2013, our group has developed an impressive multi-service track record in Maritime and Aviation.

Maritime Vessels Under Management

Real Assets Acquired Under Management

Advised In Enterprise Value

Loans Through Our Exclusive Lending Agency

Venture Portfolio Companies

AUM* under the Seahawk Equity Long-Short Fund

*As of 31.01.2024

vessels sold and chartered

We pride ourselves on a diverse and dynamic team of specialists working as one cohesive unit across the globe.

From environmental sustainability to multi-functionality, we take a look at the different aspects of modern ship design that will influence investor decisions. […]

From environmental sustainability to multi-functionality, we take a look at the different aspects of modern ship design that will influence investor decisions. […]

It is with deep sadness that Transport Capital announces the passing of our dear colleague and friend, Oliver Faak. […]

As the world grapples with economic shifts, the maritime venture capital landscape is also undergoing transformations. As understanding and adapting to these changes are imperative for capitalising on emerging opportunities, let’s delve into three key talking points that underscore the profound impact of global economic changes on maritime venture capital. Trade Dynamics and Maritime Investments […]